After all the chicken Little people crying out recession (the damn media sensationalizing bad news), official GDP figures released on Monday (30 April) shows that the US grew 0.6% in the first quarter, official confirming that there is no recession (to be in a recession, GDP must be negative for two consecutive quarters/6 months)…at least for now. That shows you cannot believe anything you read in the newspapers nowadays.

In fact, there was a series of surprising economic reports that shows a recession is not likely developing:

1) Consumer spending increased by 1%

2) Unemployment rate for April improved to 5%, down from the 5.1% figure in March

3) Nonfarm payrolls for April decreased by 20,000, much less than the 81,000 reported in March, and less than the 75,000 decline that economist predicted

4) Factory orders for March climbed 1.4%

5) US Dollar is showing more strength while commodity prices are beginning to come down (as a result of the FED signaling an end to interest rate cuts). This should reduce inflation and improve consumer’s disposable income further.

Not Bad…But Not Good Either

Note that the data coming out is NOT good, it’s just not as bad as what everything has been saying. The US is unlikely to go into a recession, but growth will remain sluggish and flat, at least for the next quarter. The good news is that the fiscal stimulus package and the aggressive interest rate cuts HAS NOT even taken any effect Yet. Once the FEDs actions start taking effect in the second quarter, economy is likely to start growing again by the second half of the year.

The Market Update

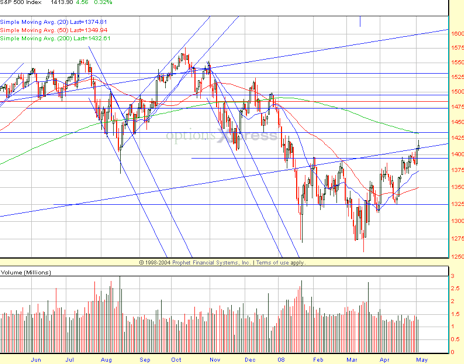

The S&P 500 managed to stay on an uptrend above it’s 20 & 50 day MA and breaking through and stay above the 1400 resistance, while the Dow broke through the 13,000 resistance and has stayed above. On the Singapore front, the STI progressed through the 3,000 point barrier to close at 3200 points.

My Wealth Academy Portfolio is finally in the green, with my Singapore stocks up +7.32% for the last 4 months and US stocks up just +0.43%, powered mainly by the strong gains in Apple (+41.8%), Google (+12.37%) and Visa (+38.1%)

If you want to learn how to massively profit from the markets, join me at the next Wealth Academy Live Training in Singapore 15-18 May! Call 62740105 and speak to Wandy/ Terence before all the seats are sold out

how to use this situation as our benefit ?

the strategy you prvide here are very effectif

and unique guys

Hi, adam, I am one of the students who attended your “I am gifted, so are you” camp 3 years ago. I wish to thank you as I have been achieving success in my studies since. I have managed to score top 3 during my year 1 first semester in my poly, and top 2 in the 2nd semester.

I have download and listened to the “Pattern of excellence” introductory seminar recording, but may I ask what is the name of the piano musics played at the background. Thank you for taking time to view this comment.

I think recession or not, it doesn’t matter because there are always some opportunities in the market.

So is this recession happening now or soon?