If you have been following the US market, you would know that it has been rallying like crazy for the last week, primarily driven by low oil prices and increase in consumer confidence. The Indices now sit on a 5-year high! What makes this amazing is that it is doing so in one of the worst months in history (Sept has been the worst month for the indices).

However, I still maintain my stance that it is due for a serious correction for the following reasons.

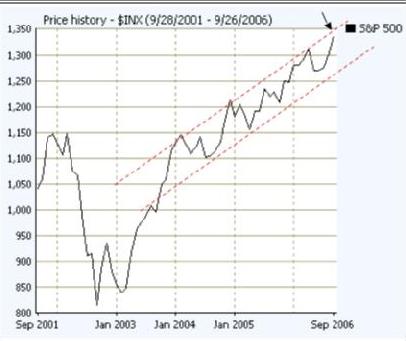

1) The S&P 500 (now at 1337) is now sitting very near on its upper trend line (resistance line in RED) of 1340, which means that if it maintains this trend, it will likely correct down to support line at 1300 or lower.

2) Although the S&P 500 & Dow are shooting up, the stocks that are increasing are not leading stocks (those with the highest EPS rating, Relative strength rating) as measure by the IBD 100 (investors.com), but are stocks coming from non-leading stocks like Property Stocks etc…

3) Those who are buying up the stocks tend to be more individual investors and not large buyers like institutions and mutual funds, which puts a big question mark on the sustainability of the buying

4) October is still coming up…And October has been historically the second worst month of the year where all the major crashed occur.

5) There is still a real concern that the US economy is slowing down. However the Euphoria of falling oil prices and the FED holding off any interest rate increases has blinded most bullish investors towards this fact.

Bearing this in mind, I am still holding on to my value stock portfolio as most of them are pretty undervalued and won’t be very much effected even with a much needed correction. However, I am maintaining a short position on the S&P 500 index until as least after 31 october

Hi Adam,

What do you make out of the stock market rally of late?

Been wanting to get in, but am worried of a sudden downswing.

Rgds.