During the last Wealth Academy, a couple of people asked whether property was a good investment, especially in Singapore. Well, I am no property expert, but I did make quite a handsome profit on a property (semi-D) I bought 2 years ago. Bought it for $1.7m and not just got the latest valuation of $2.5m (50% increase in 2 years). So will property continue to boom in the next 5-10 years?

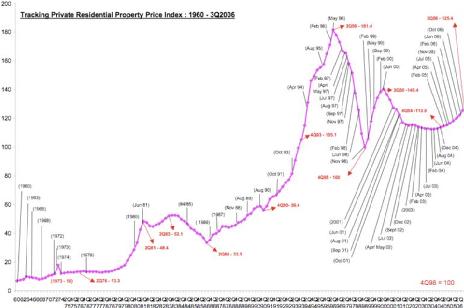

I did a bit of research and found the property index chart for the last 46 years (attached below). After punching in the values in my financial calculator, I found that the annual compounded growth rate in property is 6.73% over the last 43 years.

(Source: Redas.com)

Some people might think that 6.73% in too small a figure. Well, remember when you buy a property, you NEVER pay the full price of the house. You put a 20% down payment and borrow 80%. So what does this mean?

This means that if you had $100,000 to invest (to keep it simple)

=> You will be able to buy a property worth $500,000 (since you get 5 x leverage)

=> Assume you pay an interest rate of 3% for your mortgage

=> Your actual return will be 6.73%- 3% = 3.73%

=> So, your $ return will be ( 3.73%) x $500,000 = $18,650

=> Your return on investment will be $18,650/ $100,000 = 18.65% return!

So, with the power of gearing, investing in property over a long period of time will give you a 18.65% annual compounded rate of return (this is interest rate is 3%, for simplicity sake). However, this assumes you hold property through UPS and DOWNS

However, if you know how to study the property price chart and buy just as it is on an uptrend (LIKE NOW!!!) and get out when it begins to turn into a downtrend, then you could be making a lot higher returns. You can actually APPLY what Conrad and I taught at Wealth academy about TEHNICAL ANALYSIS on property charts. I guess I went in at the right time 3 years ago and just caught the new bull run. According to a statement made by Singapore billionaire Kwek Leng beng (Chairman of Hong leong Group), this bull run would be Singapore’s strongest and could last to 2012.

Have Fun and Make Money

Adam Khoo

Thanks for sharing Adam. It seems that my intention to buy a flat here (to save money) will turn out to be an investment.

Btw, you may consider teaching this in WA as well. I think it’s really helpful. IMHO, investing in property is more or less similar to value investing.

Kenny

http://www.kenny-tran.com

Thanks for confirming that we can apply TA on property charts as well.

I have a property at Meyer that I bought during the SARS period, it has also gained about 50% since. However, the rental collected was very low and I am still bound by the tenancy agreement that lasts till Oct this year. I was studying whether to take profit or hold. Now, with your e-mail, at least I am more confident how to reseach, analyze and make an informed decision.

Thank you so much, Adam. Whatever I have invested in attending your program is more than worth it by heaps.

Gratefully,

Fong

Hello, I’m just wondering when the actual dates are for your : ‘I Am Gifted, So Are You!?

This is because I go to boarding school in England and we break up for summer holidays on the 6th of July, and I so badly want to enroll my self on your program that I’m praying it wont be before then. If it is, how many times a year do you do run the seminar??

I’m sounding so desperate I know, I’m doing my A Levels next year (as in I’m in the first year now), and I’ve been going down a spiral I’m just looking for something that will push me back again and trying my last attempt at succeding academically and in life before its too late!

I got this site from your book: Master Your Mind, Design Your Destiny (thanks so much for writing it, I have never seen a book which has adressed all of my habits/personality trait that’s contributed to my failure experiences).

I would be grateful if you can email me at: my.draught.of.delicate.poison@googlemail.com for the final dates of your programs.

Thanks and take care,

Jayne (16 yrs)

Not sure whether property index is in tandum with the share technical analysis. Any research on this area?

As far as I know about investment in property, it is good to hold two – one for stay and one for investment. If you only have only one, most likely you have to either sell high buy high, or go for a higher rent after you cash out. Look at those en bloc owners, after cashing out they have to either find a place to rent (one of the contributing factors for the current shortage in houses/apartment for rent), or they have to downsize or move to a less desirable location if they want to keep some cash. Pity the old folks who do not wish to go for en bloc.

So who is the winner? Govt who collects stamp duties and investors who hold more than one properties.

Elaine

Hi Adam,

I wrote an article comparing ETFs and Mutual Funds. I spent a lot of effort to write out the whole article and think that it will be a pity if it goes unseen. I hope that you can read through and offer your valuable insights or maybe even post on your blog for your viewers if you think it is useful. The article is over here:

http://www.firstmillionchallenge.com/mutual-funds-vs-exchange-traded-funds/

Do let me know what you think.

Regards,

Hang Wei

Hi Adam,

One question from me, if you had $100,000 now, would you invest in properties or other investments ?

Is it the best investments currently let’s say we have the holding power to hold for another 30 years.

Will properties’ return remain stronger than other areas like stocks or options?

Thanks

Vanson

http://www.funmobilephones.com.sg

Hi Adam,

That’s a great analysis on ROI. I have another version, taking advantage of today’s high rental yield.

As under $1m property appeals more to most people, let’s take example of a 2rm property in District 11 (abt 12mins walk from Novena MRT) at $900k.

Assuming 80% loan at 3.5%…

Property Price: S$900k

Your Investment: $180k

Monthly Installment: $3233

Potential Rental Return for this property has been between $3800 – $4200 in the past 3 mths. But let’s use the lower rate.

At $3800, means a Rental Yield of 0.506%(3800×12/900k). That’s not bad for Singapore investment!

But then, again like Adam points out, your actual investment is really the initial capital of $180k, so adding misc cost like stamp-duty, maintenance, legal, etc, your total cost is perhaps $205k.

Therefore, using $205k of your cash to invest in property that generates $45.6k annually means a whopping 22.24% ROI !!! Now which investment in Singapore gives you such return over 2years at least. Not forgetting you still own a physically asset, which has no monthly installment to worry (as the $3800 rental pays the monthly installment of $3233 $180 maintenance fees).

Not forgetting, you can also potentially collect “bonus” in capital appreciation, during a bull-run, as Adam quoted Kwek Leng Beng above that it may run to 2012. Assuming annual growth of 6%, that could mean potentially capital appreciation of at least another $100k to $200k. That should more than take care of all cost, including interest incurred over 2years.

of course, like any investment with high returns, there’s always downside risk. But unlike stock (which can drop to 0), you still have a physical asset that you can still rent out if the market is not favourable for sale, and generate income to pay towards part if not all of your monthly installment while you wait for the next wave.

So the bottom line is, may sure you have holding power before you enter any investment. Not only should you have the cash to invest, but also the cash to hold to weather thru any storm.

Sigh… now we know why why the rich people gets richer.

Hi Adam,

Good analysis.

The trouble I see is that people do not want to “get out when it begins to turn into a downtrend”, expecting it to go higher and higher forever.

hi,

which one is better for investment ? Singapore property or Indonesia property ?

thank you

Hi,

There should be other cost like agent fee, tax, and management fee , or renovation cost…

so the return should be lower. besides the past 46 years is a time singapore develop from a fish man village into a economical centre , it went through the high growing time, and turned into a developed country/city. look forward, if the goverment do not intend to pour in more foreigners, what is the motor to push the property gos up like the past?

Is it wise decision to buy property in singapore now (Feb 2010). If we give it on rental for next 4 years & then sale the property, will it be profitable?

In my opinion, HDB flats are a bit overvalued now and private property is at fair value. Unless I get a super god deal where I get to buy something 10-20% below market value with a good rental yield, I will not buy now.

Hello Adam,

What is your opinion about HDB at Jurong East area? Dont you think that its prices will go high as the place is very near to Jurong International Park and new hospital, commercial buildings are being build there? I guess most of the emplyoees working at IBP & in this new commercial buildings will need house at nearby their office. At present rental yield at Jurong East for 3 room unit is around 6.7 %. However, price is NOT less than market value. I am planning to buy 3R unit. Please advise..

I specialize more in studying and buying private property only. However, my feel of the HDB market is that it is currently overvalued as sellers are asking for cash over valuation most of the time. No matter how good a property, never overpay for it. In fact, always make sure that you buy when it is undervalued. The best time for this is when everyone is pessimistic, property prices are down and when there is a recession. Buy low and sell high! Now, it’s buy high….hoping it will go higher.

Hi Adam,

As the private property is going up now, is it the best time to invest now or should we wait.

Hi Adam,

I have been looking aroundd for an investment opportunity in property. However, as I took too long to materialize, I missed ample opportunities. Examples, Domus 2 B/R was 815K in 3/2009 and now its 1.2M. Metropolitan 2 B/R was 615K in 12/2008 and now its 1M…. and the list goes on….

Should I now wait for a downturn (hopefully property bubble is forming and the world is not getting out of the recession yet, i.e. Greece, Europe….) or should I just go ahead and invest? I have 400K on hand.

No one, including me, can predict where stock or property prices will go in the short term. One I do know is that in the long term, property in good locations will always appreciate. So my advice is if you want to buy a property for investment, look for one in a very good location with high rental interest. Make sure that the rental you get CAN COVER the installments. Make sure you get a fair price by checking prices of similar units from http://www.ura.gov.sg -> latest transacted property prices. Ensure that in the event of another recession (there is always a remote possibility), you have the financial power to hold even if you lose your tenants. Over time, you will make money.

The surge property prices are probably cause by influx of PR and FT, lack of supply, low interest rates from bank, speculators and genuine investors.

Will the possibility of interest rates moving up hill in the next coming months, changes are we should see a decline in property price.

Yes, probably. I don’t see alot of huge upside from here in the short term. If anything, it should consolidate and move sideways for a while. Rising interest rates will definitely pressure prices in 6-12 months. However if the Integrated resorts become a huge success when fully operational, that may be a reason for prices to surge again

Hi Adam,

I am doing jewellery business in Hong Kong and my market are mainly Europe and USA. My son is around 3 years old. My plan is to send him to overseas study when he will be 13 years old. Singapore is one of my considerations. I would like to ask if it is good to buy a property for investment now and pay installment every month. I can also rent it out for investment purpose. Can you give me some advice. Kindly send me email reply at elzanjew@onebb.com

Lily

Singapore is definitely a good place to invest in property for the long term because of economic and political stability. However, get a good property agent to advise you well so you buy a property at a good location at a fair price.

Hi Adam,

Thanks for sharing. Find it very useful indeed.

I would like to share our Singapore Future development plan for the next 3-5 years with the rest too.

* Resorts World Sentosa

* Marina Bay Sands

* Marina Bay Financial Centre

* One Raffles Place (Tower 2)

* Asia Square

* South Beach

* Changi Motorsports Hub

* Sports Hub

* Jurong Lake District

* Punggol 21

* Gardens by the Bay

* Scape Complex

* The 2010 Summer Youth Olympic Games

* River Safari

* Changi Airport Terminal Four

* The International Cruise Terminal

* Singapore Cable Car

* Serangoon and Punggol Reservoirs

and more …

http://www.singaporeinvestmentforum.com/forums/content.php?120-property-singapore-development-investment

Hi all,

I find that you have three options regarding property investment in singapore. 1) Buy Now 2)Buy Later 3)Rent all the way. Choosing between these seemed to be very complicated issue. However, after playing around with he online tool at http://singapore-property-calculator.exofire.net , I figure that it all depends on how long you can hold on to the property. If you could hold for 10years or 15years time, then buying seems to be the best option. However, if you want to hold for 5 years, your profitability is too unpredictable. The only good thing about buying for short term would be that you can pay your rent(ie loan repayment) with your CPF and use liquid cash in hand to invest elsewhere. But in the end, if the market at your exit time drops by 30% from your buying price then you would probably take more than 50K losses after discounting the rental that you would have paid if you didnt buy! thats not cheap to me.

Is Seahill west coast or Hillsta choa chu kang a better condo for investment? Both by Far East.

Good time to invest now?

Hi,

Since you are interested in the Far-east property, you can get an additional 1% discount on top of all the discounts given by the developer.

What you need to do to enjoy this benefit is to quote that you are being referred by “Lawrence Tan” and the Far East agent can contact me directly at HP: 97770785 to grant you this 1% additional discount of your net purchase price.

Thank you.

Lawrence Tan

Dear Adam

Do you think property prices in Singapore, landed and non-landed, will start gradually declining in Q3 2012?

too much money in the market will keep property price up.